Chartered Accountancy (CA PAK)

Charted Accountancy is a rewarding career in various fields of business and finance, including financial reporting, audits, taxation, financial and general management. Charted Accountants are largely engaged in public practice and private sector. They are also extremely successful entrepreneurs.

Charted Accountancy is the most valuable qualification in the country and in abroad as well. The profession if Charted Accountants in Pakistan should be the benchmark of professional excellence upholding the principles of integrity, transparency and accountability. There is a greater worldwide demand of business managers possessing adequate managerial, decision making, problem solving and above all effective communication skills, and charted accountancy is the only answer to these requirements. The professional has stood the test of time, and career opportunities for Charted Accountants are unfolding as increasingly realize the importance of professional values, ethics and good governance. Moreover, one should opt for Charted Accountancy due to following.

- Charted Accountancy is a rewarding career and there are excellent prospects of employment in audits firms as well as in local companies, multinational, local and foreign banks.

- A Pakistani CA is considered as a competent professional all over the world.

- You will be a top ranking executive in commerce, finance and industry.

- You can be a very high level government official.

- You need not to acquire any future qualification in accountancy for the advancement of your career.

In 1961, Pakistan, a newly born country, established the institute of Charted Accountants of Pakistan through a presidential Ordinance to regulate and monitor the accounting professional across the country.

Since its inception, the Institute has strictly adhered to the policy of recognizing merit and remained committed to safeguarding public interest and ensuring ethical practices. Institute’s commitment to quality has made Charted Accountancy in Pakistan synonymous with professional excellence, integrity, transparency and accountability.

ICAP has approx. as 9000 members who are currently working in 46 countries worldwide. With thousands of students joining our prestigious fraternity, we offered approx. 382 ambassadors to the local and international market in the year 2011. The transformation to global financial reporting standards requires the internalization of new values and attitudes. At ICAP we realize that education is critical and holds together and centrifugal forces that countries to pull us towards diversification, yet persuade us to retain our distinctive identity.

The Institute of Chartered Accountants of Pakistan (ICAP) was established on July 1, 1961 under the Chartered Accountants Ordinance 1961, for the purpose of regulating the Accountancy Profession in Pakistan.

The Institute of Chartered Accountants of Pakistan (ICAP) is a professional body of chartered accountants in Pakistan, and represents accountants employed in public practice, business and industry, and the public and private sectors. The Institute is a member of the International Federation of Accountants (IFAC) which is the global organization for the accountancy profession.

ICAP has approx. 4,000 members who are currently working in 35 countries worldwide. With thousands of students joining our prestigious fratemity, we offered approx. 300 ambassadors to the local and international market in the year 2006.

The transformation to global financial reporting standards requires the internalization of new values and attitudes. At ICAP we realize that education is critical and holds together the centrifugal forces that continue to pull us towards diversifications, yet persuade us to retain our distinctive identity.

International Recognition

The ICAP’s affiliation with international bodies has enhanced the spirit of collaboration among the member countries and has played an effective role in promoting standards of competence and high quality for the accountants. ICAP is proud member of the International Federation of Accountants and has achieved global competence through adherence with quality international standards set by IFAC that are working to promote and develop best practices and values. ICAP coordinates with Confederation of Asian & Pacific Accountants to augment the accountancy standards and advance the profession by promoting harmonization through the adaptation of IFAC and IASB standards. South Asian Federation of Accountants serves as a regional platform of chartered accountants. ICAP is an active member of SAFA that serves as a professional accountancy forum for SAARC member bodies. Under the MoU signed between ICAP and ICAEW, ICAP members get exemption from the professional stage exams and mandatory training of ICAEW. ICAP members are only required to complete the advanced stage exams and the ethics module for membership of ICAEW. ICAP members with 12 years experience, through Evaluation of Experience (EvE) program, are eligible to become members of the Canadian institute of Chartered without appearing in any further examinations. ICAP members meeting the general membership criteria are also eligible for membership subject to:- Having a university degree granted by a recognized university;

- Passing the Evaluation (UEF); and

- Meeting the practical experience requirements (term, depth, breadth and progression) of the Canadian CA profession. Practical experience obtained pre-and-post-qualification as a member of the ICAP is included.

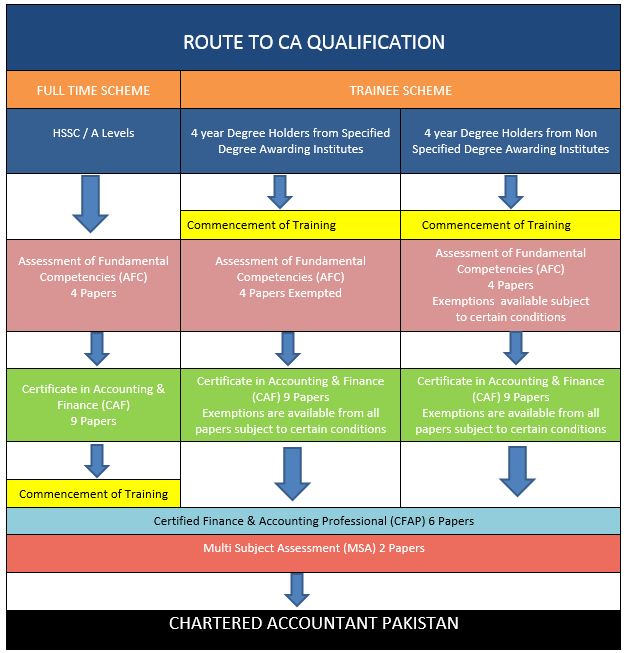

All candidates who intend to join Chartered Accountancy profession are required to have any one of following qualifications.

- Higher Secondary School Certificate with minimum 60% Marks.

- Students Below 60%, will appear in entry test.

- ‘A’ Levels with minimum two passes, or equivalent qualification.

- Graduates with minimum 45% marks

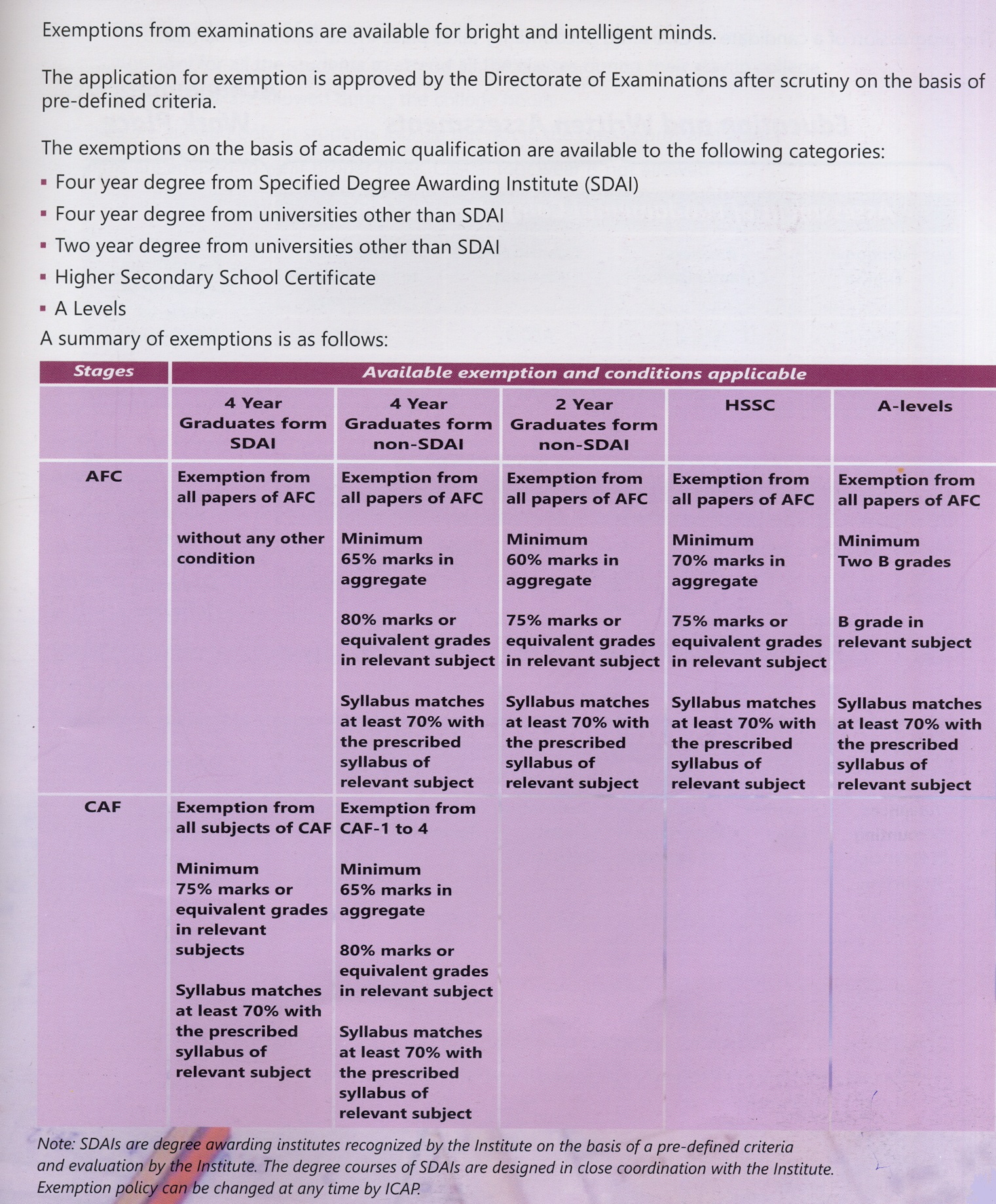

Students will be eligible to claim permanent credit in passed paper irrespective of the marks obtained in other papers of same level. Permanent credit will also be available to a student even he/she appears in one or more papers but its absent in other papers for any reason. A student will be allowed three attempts to pass each paper of AFC Level and six attempts for each paper of CAF Level. The passing rule can be changed at any time by ICAP.